Another brand new day and we are back with another new edition of ‘Decentralize Your Week‘.

In today’s edition, we gonna do some digging in the trenches for some juicy updates:

- The Solana ETF: Possibility or Myth?

- The CPI Report : June 2024

- Gari Research

- The Week in Review

The Home Coming of Solana ETF? 🏡

The SEC recently giving the green light to the Spot Ethereum ETF, max bullish vibes on the timeline.

But since the crypto community is always hungry for more, the ETH ETF seems like old news at this point.

Yesterday, a number of posts appeared in the wild about BlackRock initiating the application process for a Solana ETF.

Now before you go and move that leverage slider to 125x and go max long for generational wealth, hear us out…

Firstly, no concrete sources confirm these rumors.

It is important to dive a little deeper into the current landscape and assess the likelihood of a Solana ETF becoming a reality.

The SOL ETF: Macro Economic Lens 🔍

If data and research are anything to go by, then BTC & ETH received their own ETF after much dabbling in the traditional world of finance:

- SEC Challenges: Solana is currently entangled in court cases with Coinbase and Kraken, where it is being considered a security by the SEC. Unlike $BTC and $ETH, Solana carries this additional regulatory baggage.

Why Is Solana Viewed as a Security?

- Token Distribution: Tokenomics of Solana are way way different when compared to ETH & BTC

- Token Launch: Fundraising through venture capital and various OTC deals over the years

- Decentralization: Concerns about the level of decentralization with concentrated liquidity

While some argue that Solana does not qualify as a security, its current legal entanglements make the approval of a Solana ETF challenging.

Furthermore, Both $BTC and $ETH required futures ETF approval before any spot ETF approval.

This process took at least two years to ensure market stability and prevent manipulation. Many believe this precedent will apply to all new ETFs.

If true, this would be a significant development for $SOL, which boasts a market cap under $100 billion.

We all can now eagerly await the approval of the S-1 documents so trading of the ETH ETF can commence.

It is high time our portfolio turns bright green and on a moon mission (I am not crying, you are)

An Alternative: Litecoin

Litecoin is an overlooked Dino coin that can actually get it’s own ETF after BTC & ETH.

Litecoin, launched in 2011, has a market cap of over $7 billion and more than 4 million holders.

The approval of such an ETF could make headlines and shake up the market, and give Litecoin the boost from the trading range it has been surviving in since the end of the 2017 bull-cycle.

However, in all seriousness, the probability of a Litecoin ETF being approved this year is about as low as that of a Solana ETF— super duper low!

The CPI Report : June 2024

If your portfolio is down bad and you want to cry, then join us as we mourn the red candles together.

Bitcoin is bleeding out slowly and Alts have been kicked down to the depths of hell. But WHY you ask?

The dreaded CPI Report is due today, 12th June, 2024

There is a risk-off sentiment when it comes to financial markets during an Federal Open Market Committee (FOMC) interest outlook.

“The stage is set for a frantic macro-Wednesday, with both May CPI data and the FEDs interest rate decision poised to move the market,” K33 analysts said.

But is this truly a risk-off playbook or a wider market manipulation at play here?

this is a scam dump.

— gumshoe (@0xGumshoe) June 11, 2024

there have been 4 FOMC's in 2024

every single one of them had the same scam dump

BTC dumped 10% in the 48 hours before all of them

on FOMC day it recovered the entire move

the market always prices in overly bearish statements, then reverses pic.twitter.com/oFa801csND

According to X user: Gumshoe

While Market Makers & Whales do tend to manipulate prices to shake off retail and force liquidations, we cannot discount the fact that these tactics are unheard off.

As seen in the tweet image above, this is the 4th reoccurrence of shady price-action just before the CPI report numbers are announced and then the market goes on V-shape reversal rally on the announcement.

Will this time be different or not? We gotta wait and watch!!!

Gari Research 🔥

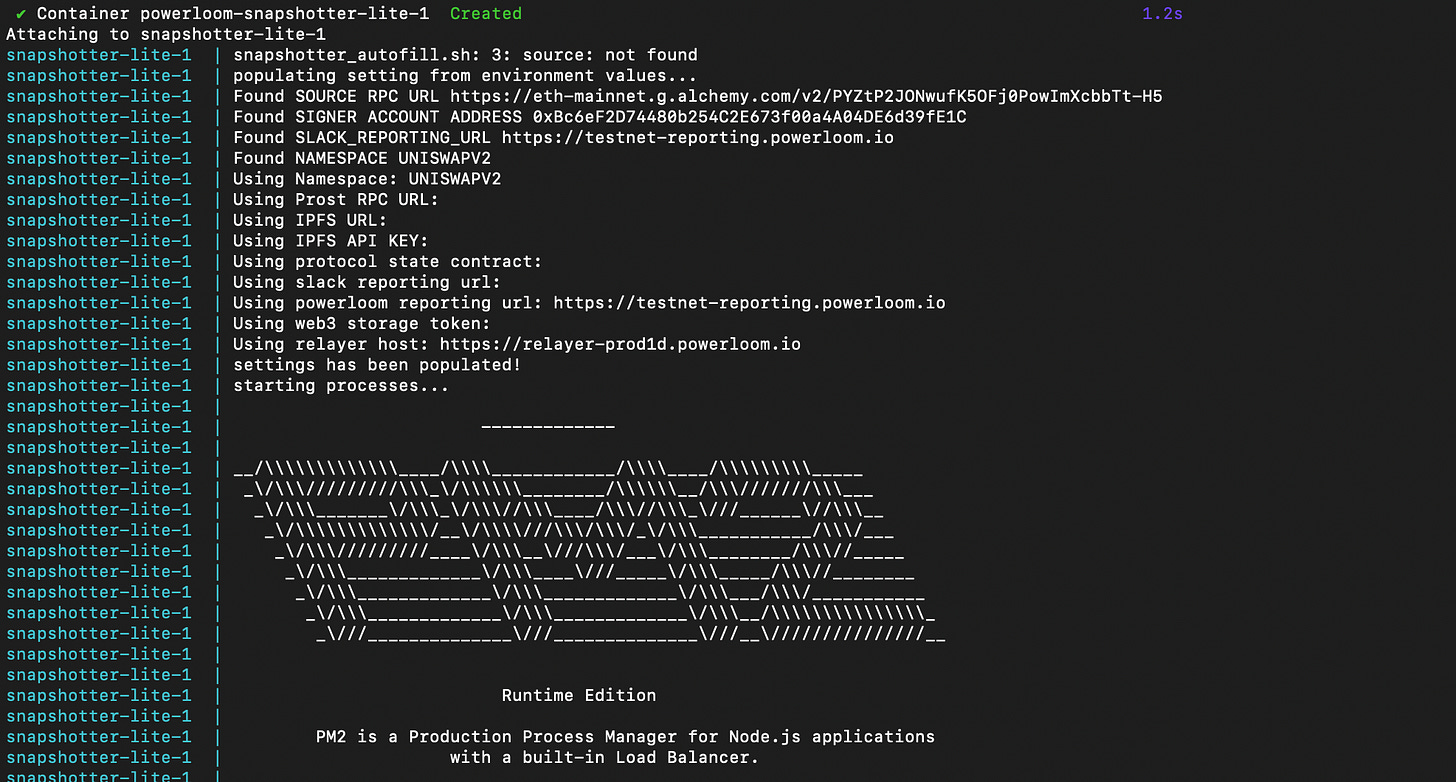

The need for Data Scalability in Web3

What is Data Scalability?

Data scalability refers to a system’s ability to handle an increasing amount of data or to expand to additional growth.

This can be further divided into two broader segments:

- Vertical Scaling: Enhancing an existing machine by adding more power, such as additional CPU or RAM.

- Horizontal Scaling: Increasing the number of machines in the resource pool.

Why is Data Scalability Important?

- Performance

- Cost Efficiency

- User Experience

- Future-Proofing

Data Scalability in Web3: Building the Future of Decentralized Applications

As the Web3 ecosystem evolves, effective data scalability becomes super crucial.

Unlike Web2, Web3’s data needs are fundamentally different due to the shift from centralized to decentralized data models. This shift affects various factors such as data requests, caching, and peer-to-peer (P2P) networks.

Why is Data Scalability Crucial in Web3?

- Avoiding Network Congestion

- Enhancing User Experience

- Increasing Cost Efficiency

- Emphasis on Encryption & Security

Key Challenges in Web3 Data Scalability

- Blockchain Size & low Transactions Per Second on Layer-1 solutions

- Transaction Throughput: Limited transactions per second (TPS) on major blockchains like Ethereum can hinder scalability

- Decentralization Trade-offs in regards to data storage and encryption

- Interoperability between blockchain is still a huge concern

All of the above can be seen as diverse players that need to be addressed as pain points to achieve data models that can be game-changers in their own right.

The Week in Review 🕵🏻♂️

Polygon announces grants program for builders: The Layer-2 project plans to bestow the gift of MATIC to entice developers with $22M (35M MATIC) in grants for building within the Polygon ecosystem. “Season 1″ is open until August 31.

$270.4 million in liquidations : The selloff has led to the liquidation of about $270.4 million in leveraged positions over the past 24 hours, according to CoinGlass. Amongst the liquidation figures, $238 million were long positions.

BNB breaks its previous All-Time High: Binance has managed to recover some of the spot market share it lost towards the end of last year. The exchange still counted for a sizable 37.5% of spot volume in November 2023. BNB surged 18.6% in just three days in early June, climbing from around $600 on June 2 to $700 on June 5. This sharp surge seemingly happened without any big news regarding the exchange or the blockchain.

A new Liquid ReStaking Platform- Mellow : “Mellow enables depositors more flexibility regarding their desired level of exposure to risk, while still benefiting from the liquidity of staked assets. This is achieved by dynamically adjusting strategies within each vault based on real-time risk assessments and market conditions,” the team claims, according to their documentation.

Memecoins are Bearish : Meme Sector Sees Sharp Sell-off as GameStop Losses Extend to 60%

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.